capital gains tax proposal effective date

Iii From a top individual rate of 882 to rates ranging from 965 to 109. The NYC rate remained at 3876.

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

. President Bidens American Families Plan proposes increasing the tax rate on long-term. Understanding Capital Gains and the Biden Tax Plan. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

Ii The Presidents plan you may recall would make the increased capital gains rate effective after April 2021. Iii From a top individual rate of 882 to rates ranging from 965 to 109. The effective date would be years beginning after December 31 2022.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. With tax writers launching mark-ups as early as Sept.

Bidens Capital Gains Proposal. The effective date for this increase would be September 13 2021. In general the Biden Administration would make its tax proposals effective January 1 2022 which is how budget recommendations are ordinarily submitted.

April 27 2021. The House bill would apply the increase to gain recognized after September 13 2021. An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate increase.

Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. Once fully implemented this would mean an effective federal. The corporate tax rate went from 65 to 725.

Note the proposed retroactivity of the LTCG rate hike. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April 28 2021. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced.

Currently the top ordinary rate for individuals is 37 but the AFP also. The top rate for 2021 is 37 plus. Minimum Income Tax on the Wealthiest Taxpayers This proposal would impose a minimum tax of 20 percent on the sum of taxable income and unrealized gains of the taxpayer.

Share to Linkedin. The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net investment income tax. The proposal to tax long-term capital gains and qualified dividends for high-income taxpayers at ordinary rates would be effective.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. In the American Families Plan AFP the Biden Administration is proposing an increased tax rate on capital gains and qualified dividends to equal the top ordinary income tax rate of 396 for households earning over 1 million or 500000 if married filing separately. The proposal would increase the effective tax rate on global intangible low-taxed income GILTI from the current 105 to a 165625 rate.

If the proposal for raising the ordinary income tax rate to 396 becomes law then the maximum tax rate on capital gains would effectively be 434 396 plus net investment income tax rate of 38. JD CPA PFS. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

Long-Term Capital Gains Tax Rates. If this were to happen. An increase in the estate tax rate from 16 to 20 was averted.

13 2021 unless pursuant to a written binding contract effective on or before Sept. Dems eye pre-emptive capital gains effective date. If this were to happen it may not only seem unfair but it is also bad tax policy.

The top rate would be 288. Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income rates with 37 percent being the highest rate 408 percent including the net investment income tax.

Rates would be even higher in many US. This would apply to. The proposal would lower the Section 250 deduction percentage for GILTI from 50 to 375.

Were going to get rid of the loopholes that allow Americans who make more. KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the capital gains tax rate may increase its the when. As you review this alert it is critical to keep in.

There are exceptions however and some are notable. The tax on capital gain of property transferred by gift or at death would be effective January 1 2022. The effective date for most of the proposals is Jan.

13 2021 unless pursuant to a written binding contract effective on. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a compendium of. The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept.

The proposal would increase the maximum stated capital gain rate from 20 to 25. The proposal would be effective for gains recognized after the. These provisions would be effective January 1 2022 except the tax rate on capital gains which would be effective April 28 2021 the date that the AFP was released by the White House.

The proposal would be effective for gain required to be recognized and for dividends received on or after the date of enactment. When combined with the proposed corporate tax rate of 265 the resulting effective GILTI would be 185625. States due to state and local capital gains taxes leading to a combined average rate of over 48 percent compared to about 29 percent under current law.

Germany Crypto Tax Guide 2022 Kryptowahrung Steuer 2022 Koinly

Economic Bulletin Issue 3 2018

9 Things You Should Know About Us Taxes If You Live Abroad

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Federal Ministry Of Finance Global Minimum Tax Frequently Asked Questions

Free Farm Tractor Bill Of Sale Form Pdf Word Eforms Free Fillable Forms Bill Of Sale Template Business Template Word Template

Germany Crypto Tax Guide 2022 Kryptowahrung Steuer 2022 Koinly

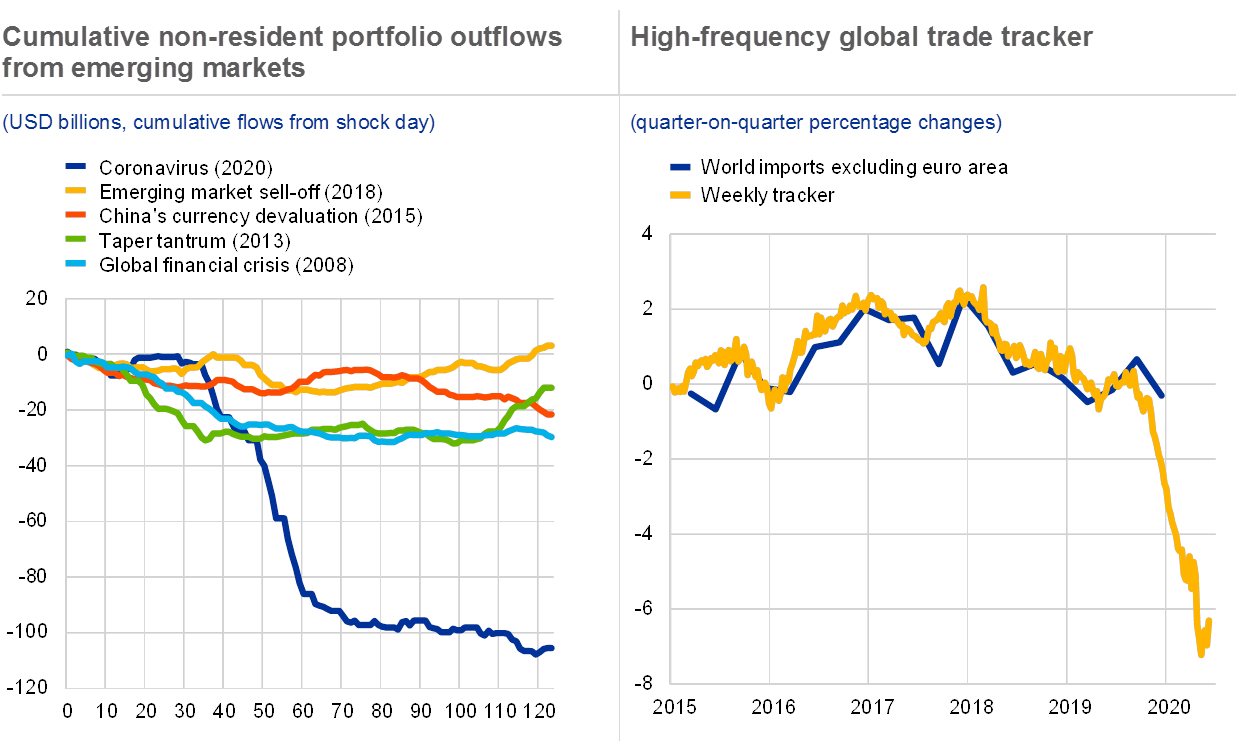

Financial Stability Review May 2020

Germany Crypto Tax Guide 2022 Kryptowahrung Steuer 2022 Koinly

Federal Ministry Of Finance Global Minimum Tax Frequently Asked Questions

Security News Trending Topics It Security Myra Security

Germany Crypto Tax Guide 2022 Kryptowahrung Steuer 2022 Koinly

What Does Being Audited By The Irs Mean Https Www Irstaxapp Com What Does Being Audited By The Irs Mean Tax Write Offs Tax Services Tax Organization

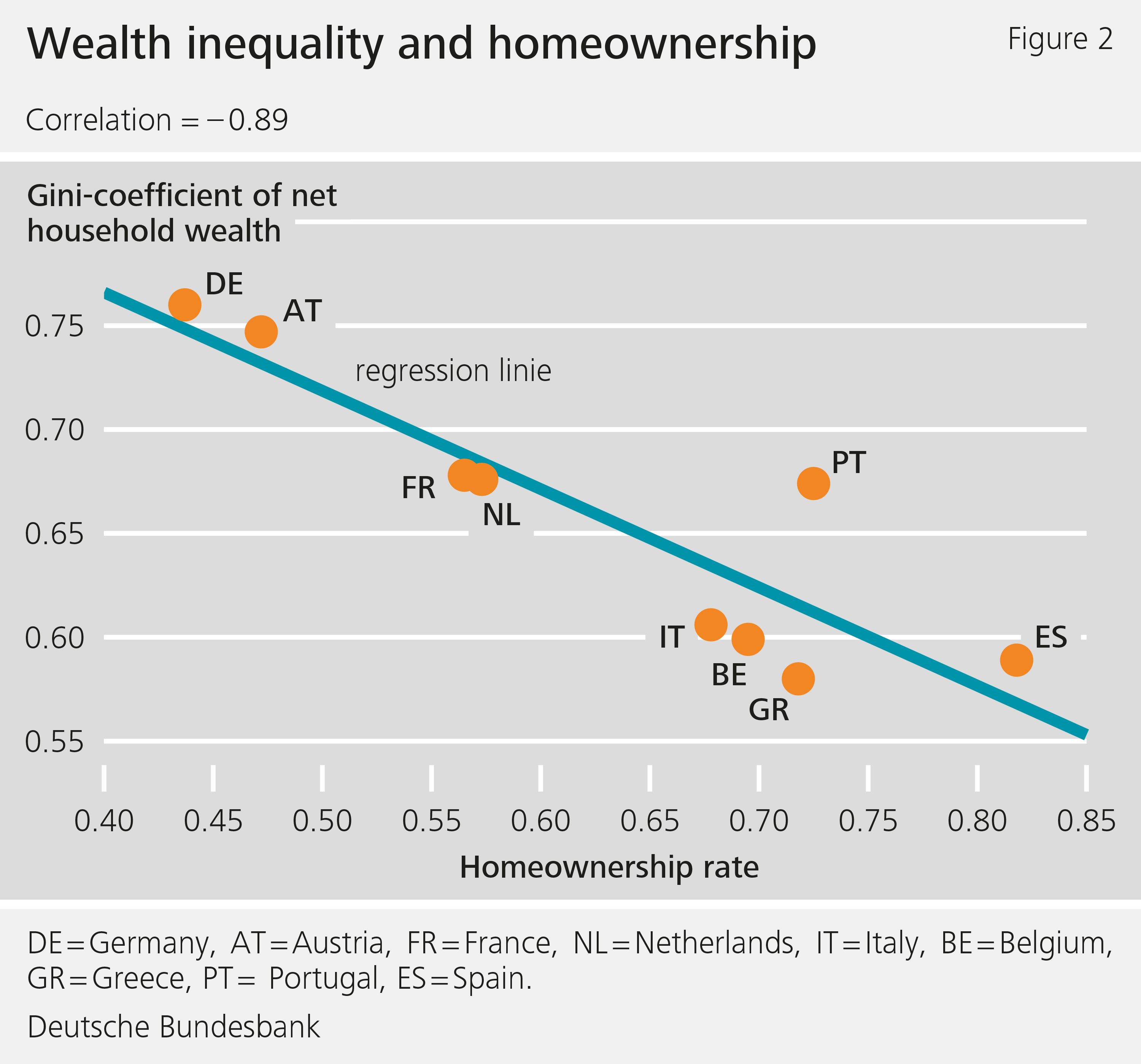

Reasons For The Low Homeownership Rate In Germany Deutsche Bundesbank

10 Sponsorship Form Templates Word Excel Pdf Templates Sponsorship Form Template Card Templates Printable Printable Place Cards Wedding