tesla model y tax credit irs

I did a little more digging on certain tax forms about bonus depreciation under 179 if the vehicle weighs less then 6000 lbs. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks.

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired

Both are work-arounds unless the IRS letter that HR Block thinks Tesla is supposed to produce says the tentative credit amount for a June 2019 delivery is 7500 - which also makes no sense.

. Apparently you can deduct up to 18100 the first year. Electronic fold-flat releases in trunk. Aspiring Tesla owners should pay close attention.

The federal EV tax credit is the first to run out for electric carmaker Tesla on Dec. Second row with adjustable seatbacks. Tesla has been selling the Model S Model X and Model 3 for years already and GMs eligibility for any portion of the tax credit ended March 31 2020.

2500 tax credit for purchase of a new vehicle. By 2020 the subsidy will be zero dollars for Tesla. Tesla Model Y Tesla Motors Democrats President Joe Biden and the UAW are well on their way to passing legislation that would increase EV tax credits for union-built vehicles.

But if you use the vehicle for business you can still depreciate it and write of up to 100 of the cost depending on the type of depreciation you choose. Federal tax credit form 8936 of up to 7500 for the purchase of some new electric vehicles. Fold-flat second row for maximum cargo storage.

April 2019 edited April 2019. WASHINGTON AP The IRS said Thursday it plans to hire 10000 new workers to help reduce a massive backlog that the government says will make this tax season the most challenging in history. For vehicles acquired after 12312009 the credit is equal to 2500 plus for a vehicle which draws propulsion energy from a battery with at least 5 kilowatt hours of capacity 417 plus an additional 417 for each kilowatt hour of.

Tesla cars are no longer eligible for the electric vehicle tax credit. So there is some confusion in this matter. Select utilities may offer a solar incentive filed on behalf of the customer.

The bill part of Democrats grander 35. It no longer applies to Tesla because the company passed the threshold of selling 200000 electric vehicles in the US. The legislation would provide a potential 12500 to be shaved off the top of any EV built in the United States by union labor.

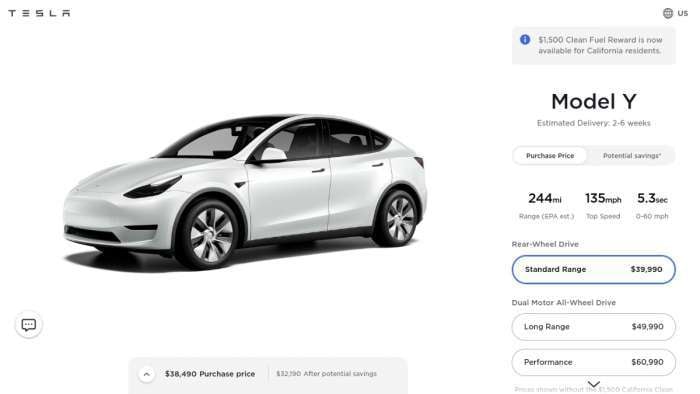

A Tesla Model Y will depreciate 49 after 5 years and have a 5 year resale value of 29758. This includes US automakers like Tesla who topped over 200000 qualified plug-in electrics sold a few years ago and as a result no longer qualifies for any federal tax. It also assumes a.

The Plug-in Electric Drive Motor Vehicle Credit electric car tax credit is a short-term incentive to offset the initial higher purchase price of qualified vehicles. April 2019 edited April 2019. This federal tax credit ranges from 2500 to 7500 for qualified electric vehicles that draw energy from a battery.

The federal government may be bringing back the EV Tax Credit for manufacturers like Tesla and GM who are no longer eligible. Claiming Tax Credit from IRS. This may allow you to claim a nonrefundable 7000 credit down by 500 for buying a new Tesla or GM electric vehicle part of the Growing Renewable Energy and Efficiency Now GREEN Act.

These results are for vehicles in good condition averaging 12000 miles per year. Tesla and GM are set to regain access to tax credit worth 7000 on 400000 more electric cars in the US with new proposed reform of the. This question regards submission of my request for 7500 tax credit for 2018.

Tesla Model Y SUV unveiled. EV tax credits. I believe Anyway the new Tesla Model Y came out for the consumer and it is below 6000lbs which is the threshold for qualifying.

1500 tax credit for lease of a new vehicle. Congress eyes 4500 boost to EV tax credits but Teslas Elon Musk isnt happy. The chart below shows the expected depreciation for the next 10 years.

The price cuts come as the recently proposed law to renstate the 7000 EV tax incentive makes EV buyers. As most people know there is currently a US. My accountant seems fairly blase regarding submission of forms while someone on this forum referenced a form 8936 obtained from the IRS that has a maximum credit in box 10 of 2500 per vehicle.

Continouing with its price cuts Tesla has once again lowered the price of the Model 3 Y. Has sold more than 200000 vehicles eligible for the plug-in electric drive motor vehicle credit during the third quarter of 2018This triggers a phase out of the tax credit available for purchasers of new Tesla plug-in electric vehicles beginning Jan. Mazers when did you receive you model 3 and how much was your federal tax liability before the credit.

WASHINGTON The IRS announced today that Tesla Inc. Manchin a no on Build Back Better bill putting 12500 incentive in doubt. IR-2018-252 December 14 2018.

Senator Joe Manchin said on Sunday hes a no on the sweeping spending plan which includes up to. Are Any Other Manufacturers Close to.

9 Things I Hate About The Tesla Model Y Daniel S Brew

Tesla S Discount Car Insurance Coming To More States Should You Hop On

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Tesla Delivers Its 200 000th Car Triggering The Ev Tax Credit Phase Out Period

Model X May Qualify For Preferential Tax Treatment

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Roadshow

Tesla Model X 6 768 Lb Gvwr Qualifies For 25k Business Tax Break

Tesla Model X Plaid Just Did A Quarter Mile Test And It S Faster Than A Ford Gt

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Latest On Tesla Ev Tax Credit March 2022

How Much Tax Credit Do You Get For Buying A Tesla Credits Zrivo

Why Are Tesla Electric Vehicles Not Eligible For The Tax Credit

Tesla Model Y Price Goes Up Could Ev Tax Credits Be The Reason

Preview Fisker Ocean Sails Into Tesla Model Y Waters Tesla Model Suv Models Suv Reviews

How To Get A Tesla Model X For 30 Off Section 179 Tax Write Off Youtube

Tesla Cuts Model 3 Y Prices As New Federal Tax Rebate Makes Customers Delay Their Purchases Torque News

Bmw I3 Vs Tesla Model 3 Comparison Kelley Blue Book

A Bigger Tax Credit For Going Electric What It Could Mean For Consumers Forbes Wheels